What's for Dinner Ma'? Money Left on the Table? - Economic Value Estimation® (EVE)

I have spent a lot of time in Chicago, one of the best food cities in the country, and home to one of the most notorious historical pen authors in history, Ann Landers of the Chicago Sun Times. I didn’t realize how much I would relate to her advice until I read something that she wrote which absolutely rings true with respect to B2B and B2C product marketing – “Too many people today know the price of everything, and the value of nothing.”

If you are in marketing and have the awesome responsibility of owning product / service pricing for your organization, you better have a good understanding of the value of your offering before you take any pricing action. Just as cash is king in terms of working capital, value is king in terms of pricing. After all – ideal pricing is essentially a literal quantification of value.

If you are in marketing and have the awesome responsibility of owning product / service pricing for your organization, you better have a good understanding of the value of your offering before you take any pricing action. Just as cash is king in terms of working capital, value is king in terms of pricing. After all – ideal pricing is essentially a literal quantification of value.

So, the holy grail of pricing is understanding value of the product or service being offered – how hard can that be? Well, there are a couple of definitions of value that are very important and are the reality in every market. There is the consumer’s perceived value of the offering, and there is your organization’s perceived value of the offering. These are often very far apart, which is one indication of a lack of understanding the market. The closer these two are aligned with each other, the more value you will be able to extract for your offering.

Your next question might be “How do we use value to set prices?” In order to answer this, we need a standardized way to break value into individual components and understand how we can influence each of them.

There are many value decomposition models in existence including:

- Economic Value Analysis (EVA),

- Integrated Value Approach (IVA),

- Total Cost of Ownership (TCO),

- Economic Value Estimation (EVE®, Nagle & Holden, 2002),

- Economic Value to the Customer (EVC),

- Economic Value Pricing (EVP), and the list goes on…

For the purposes of this discussion I will focus on Economic Value Estimation® which is a very widely adopted framework that is utilized to assess value in a market.

Enter Economic Value Estimation®

The basic premise of this framework is that all competitive products have an established level of perceived value in the marketplace.

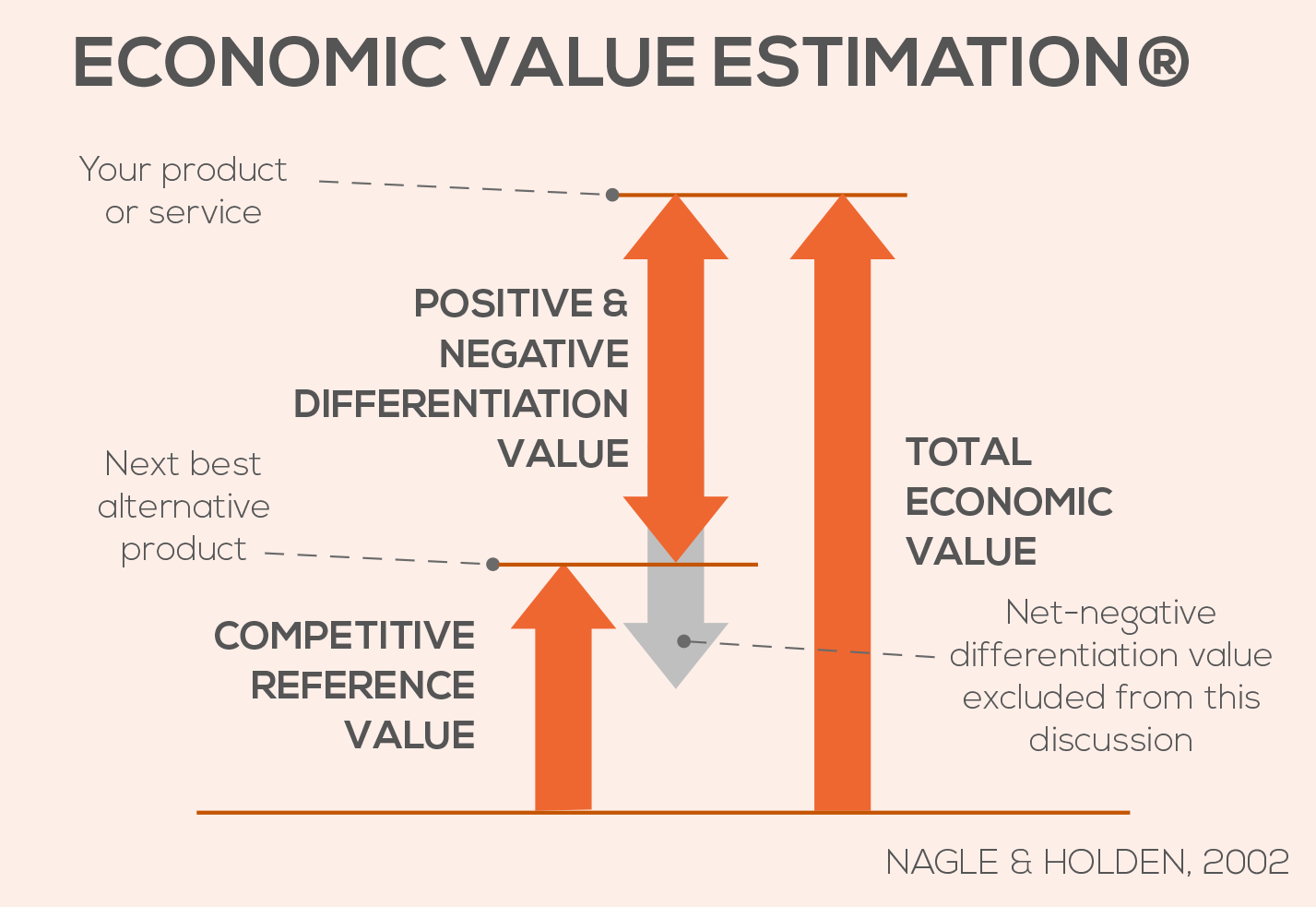

Knowing this, if you examine the closest competitive alternative to your product the estimated level of value that it embodies is defined as the ‘reference value’. Your organization’s product/services also have perceived value – both good and bad perceptions of value. This positive and negative ‘differentiation value’ is based on potential customers comparing your products’ relative features and benefits to their next best alternative. This ‘differentiation value’ is then measured relative to the ‘reference value.’ The competitive reference value plus the net differentiation value (positive differentiation value plus negative differentiation value) equals the Total Economic Value. If your product’s differentiation value is net-negative, this indicates an entirely different set of serious product issues that we won’t address in this discussion.

The ideal price should be less than or equal to the Total Economic Value (the perceived consumer value) but more than the competitive reference value (assuming there is some net positive differentiation value for your product). If price is set above the Total Economic Value, consumers will think the value they get from the product is not worth the price.

So, how do we quantify all of these values? Ideally, if a competitor has perfect information they would set their price equal to (or just under) their Total Economic Value – this way, the consumer feels like they are getting the same or a little more economic value than the price they are paying. As we know, this is rarely the case. Competitors often are not informed on value, use cost based pricing, margin markups, or other competitive price points to set their own price. In addition, buyers will often negotiate the ‘list’ price down to the level of value they think the product is worth. This is why effort should be spent researching competitor transacted prices – pricing of sales transactions that customers actually paid, in other words, the price that is net of any on & off-invoice discounts.

The process of identifying the positive and negative differentiation value is focused largely on comparing your own product or service to the consumer’s next best alternative. The differentiating features and benefits of your product are then quantified, which can be done based on primary market research using tools such as Willingness-To-Pay studies or Conjoint analytics. The quantification of the differentiation value represents the additional value that your product is perceived to offer buyers as compared to their next best alternative product (again, we are assuming that the net differentiation value is positive for this discussion).

Both the competitive reference value and the differentiation value are then added together and used to guide pricing based on what your market objectives are. Does your organization want to gain market share? Are you introducing a new product? Are you trying to harvest as much profit as possible? You will then set your prices by considering the Total Economic Value of your products and your strategic objectives.

Sound a bit complex? Well, unfortunately there is no ‘Easy Button’ for value based pricing. If there were, every company would be setting their prices at the right levels leaving no money on the table – and this is one thing we have proven over and over again – almost every company is leaving money on the table when it comes to pricing their products and services…

A few key takeaways from this discussion on value based pricing are to:

- Adopt a view of value for your organization and make sure that everyone really understands what it is and why you are using it.

- Take the time and resources to understand your product’s feature set, the benefits those features provide, and the value that customers achieve from those benefits.

- Study and understand your competition including their products (again – features drive benefits, benefits drive value) as well as their strategic objectives.

- Put in place a process to incorporate the understandings from 1, 2, & 3 into your price setting methodology – this could be as simple as a process change or as complex as acquiring new talent, or even implementing formalized pricing tools (see our discussion on Pricing Capability Maturity).

All of these suggestions seem logical but can be challenging to implement, especially in the midst of conducting day-to-day business. Many companies consider using a partner to help them through the journey, there are many experts out there (and of course we would love to tell you how we can help if you are interested).

Either way, if you put these suggestions into practice you will be well on your way to establishing and defending a competitive advantage and not leaving money on the table!

About Author

Oliver Griebl

Stay up to date.

Subscribe for periodic updates on the latest happenings in life science and healthcare marketing.

Subscribe Here!

Related Posts

Ingenuity is about being clever, original, and inventive. It means finding a way to accomplish your goals

BY Oliver Griebl

What price can you put on a sound pricing strategy? We’...

BY themarketelement

All too often we think of change in a negative light – ...

Comments